Import procedures and documentations

Table of Contents

Toggle

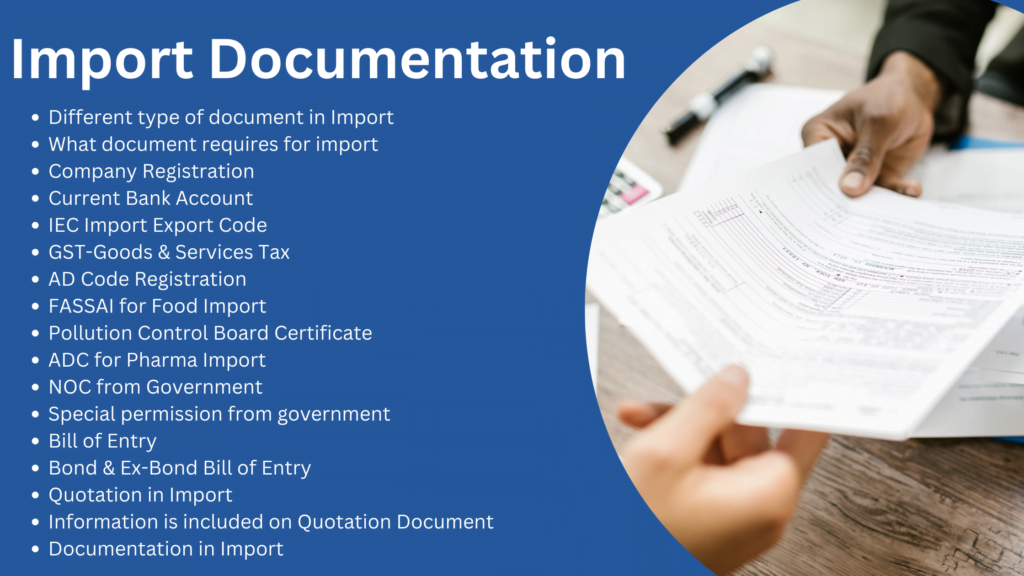

Different type of document in Import

- Bill of Entry

- Commercial Invoice

- Packing List

- AD Code Registration

- Bill of Lading or Airway Bill

- Import License

- Certificate of Insurance

- Letter of Credit

- Technical write-up or literature (Only required for specific goods)

- Industrial License (For specific goods)

What document requires for import

- Bill of Entry

- Commercial Invoice

- Packing List

- Bill of Lading/Airway bill

- Import License

- Insurance Certificate

- Purchase order/Letter of Credit

Company Registration

- Establishing an organization

- Opening a bank account

- Obtaining permanent account number (PAN)

- Obtaining Importer-Exporter Code (IEC) Number

Current Bank Account

- Business payments and receipts are done using such a current account; it provides the benefits of an overdraft facility or loan facility to the current account holders for business operations, and hence, it is the most preferred account by the businessman. A current account can be created by an individual, partner, firm, company, trust, or association.

IEC Import Export Code

- IEC, or Importer Exporter Code, is an alpha-numeric code issued on the basis of the PAN of an entity. To import or export in India, IEC is mandatory; no person or entity shall make any import or export without an IEC number, unless specially exempted.

GST-Goods & Services Tax

- GST registration is mandatory for taxable persons under GST. You would be required to get GST registration after crossing the limit of Rs. 20 lakh.

- Export of goods and services or both on the payment of integrated tax, and the exporter can claim a refund of GST paid on such goods and services they exported.

AD Code Registration

- The AD Authorized Dealer Code (AD Code) is a 14-digit numerical code provided by the bank with which your business has a current exporter who has to register the port. Where he is clearing customs or exports from any port, he must register this code.

FASSAI for Food Import

- Food Safety and Standard Authority of India (FASSAI) is an autonomous body established under the Ministry of Health and Family Welfare and the Government of India.

- FASSAI is responsible for protecting and promoting public health through the regulation and supervision of food safety.

- FASSAI registration is mandatory for those who are doing business with food. Compliance that ensures the safety of food products supplied or manufactured by various establishments in India.

Pollution Control Board Certificate

- One of the requirements to import some of the specific products that affect the environment is to obtain a certificate from the pollution control department of the importing country.

- Importing hazardous waste material is subject to control by the pollution control department. The importer is required to obtain a permit for the import of hazardous waste. For the import of hazardous wastes controlled under the based conversation and hazardous waste and its regulation.

ADC for Pharma Import

- ADC means Assistance Drug Controller; you need to get a NOC from ADC. When you import medicine, OTC products, or cosmetics on a commercial basis, on a on a personal basis, or as a gift to your friends (on a non-commercial basis), an ADC NOC is obtained from the airport.

NOC from Government

- If any product is exported or imported that contains a harmful related product, such import or export is permitted with a NOC (No Objection Certificate) obtained from a different office.

- If you want to export or import medical-related products, you have to get permission from the from the drug control office of the government.

Bill of Entry

- A Bill of Entry is a legal document that is filed by importers or customs clearance agents on or before the arrival of imported goods. It’s submitted to the customs department as part of the customs clearance procedure.

Bond & Ex-Bond Bill of Entry

- The Ex-Bond Bill of Entry is filed to allow the importer to take items from home consumption as needed from the bonded warehouse described above. When an ex-bond bill of entry is filed manually and no EDI facility is available, it is in green.

Quotation in Import

- When importers source new products and connect with export, The exporter is providing all the information related to the product and delivery, which is called a quotation document.

- The exporter will ensure that there are no disputes relating to product quality, specification, or delivery terms. In the quotation, all terms and conditions must be clearly mentioned, like payment terms, delivery termus, production specifications, etc.

Information is included on Quotation Document

- Seller company Name, Address & Contact details

- Buyer company name

- Product Description-HS Code, Description & Specification

- Product Quality & Quantity

- Product Pricing

- Incoterm Graph

- Invoice Currency

- Shipment Terms

- Payment Terms

- Estimated supply consignment

- Estimated shipping details

What is Performa Invoice (PI)/Contract?

- Performa Invoice is a type of contract which is sent to buyer for signing a contract & conformation of Order. In Performa invoice describe the purchasing items, packing list, Shipping weight, Transportation charges & Other many information is described.

- The purpose of the Performa Invoice is to make an easy process of sale.

- Once you send the Performa invoice, then customer is agreeing on price then you can send goods & services.

- Instead of demanding payment, Performa Invoice provides good-faith estimations, ensuring that the consumer understands exactly what to export. And the customer receives all necessary information and clarity regarding the transaction.

What is the Commercial Invoice?

- The commercial invoice is most important document in international trade ocean freight shipping.

- It is a legal document issued by Exporter to the importer in an international transaction & serves as a contract & a proof of sale between the buyer & seller.

- A commercial Invoice is a special document that help your package get through custom.

- Correct commercial invoice of assets for export helps the customs authorities to immediately decide the taxes and import duties applicable on the consignment, thereby avoiding delays.

- Commercial invoices contain a lot of important information about your shipment, such as where it came from, where it’s going, what it is, how many there are, what it’s used for, what it’s made of, and how much it costs.

Packing List

- Packing List is a document used in international trade. It provides information related to exporter & importer name, port of origin & port of destination, international, Freight Forwarder information about the shipment how it packed, Pallets Boxes, Weight, which type of material used in packaging & number that are noted outside of boxes.

Bill of Lading

- Bill of Lading is a required document to move a freight shipment. The Bill of Lading (BOI) is receipt of a freight services, accountant between freight carrier & shipper & a document of title.

- Bill of Lading is a document which is binding to driver & carrier all the details needed to process the freight shipment & invoice correctly.

Air Way Bill (AWB)

- An air way bill (AWB) is a document that accompanies goods shipped by an international air courier to provide details information about the shipment it to be tracked.

- There are multiple copies of the bill. So, that each party involved in the shipment can document it. The air consignment note is a type of bill.

Lorry Receipt (LR)

- The lorry receipt is given by the goods carrier whenever the goods are delivered by road.

- In receipt contain details name ,address of couriers, Identity of consigner, The date of booking of the consignee, Title place of origin to destination, Description of goods, The quantity of parcels total weight & freight costs.

E-Way Bill

- E-Way bill is an electronic way bill for movement of goods to be generated on the e-way bill portal.

COO – Certificate of Origin

- The certificate of origin (COO) is a document issued by an exporter which is provided details information a product is manufactured in a particular country.

- This document ultimately contains information regarding the product, its destination & the country expert.

Fumigation Certificate

- In most of the cases, Wooden material is used in packaging for export. Buyer insists suppliers to fumigate cargo & asked to provide fumigation certificate along with other export document.

- Fumigation is a legal requirement by the buyer in most of the country’s fumigation certificate is issued by fumigator obtained approval for fumigation from licensing authority.

- Most of the countries is not allow import without fumigation.

Phytosanitary Certificate

- Phytosanitary Certificates for exports or re-export man only be issued by a public official who is technically qualified & duly authorized by the NPPD.

- Phytosanitary certificate for export is usually issued by the NPPD of the country where the plant product or regulated article was grown or processed.

Insurance Certificate

- A certificate of Insurance is a document used to provide information on specific insurance coverage.

- The certificate provides verification of insurance & usually contains information on types & limits of coverage, Insurance Company number, Named issued & Policies effective periods.

Testing Report of Product

- Product Testing is also called consumer testing or comparative testing, is a process of measuring the properties or performance of products.

- Product testing might be accomplished by a manufacturer, government agency an independent laboratory.

Health Certificate

- Health Certificate certifying that the government body of the exporting country has been examined this particular goods consignment. This certified also certifying the food of animal origin or non-exporting is fit for human consumption.

MSDS Material Safety Data Sheet

- The Material Safety Data Sheet is a technical document that provided details & comprehensive information about a controlled product including.

- Health effects resulting from exposure to the product.

- Risk assessment related to the handling storage or use of the product.

- Measure to protect worker at risk.

- Emergency Procedure

Third Party Inspection Certificate

- Third Party Inspection (TPI) is the inspection & testing activities by the third party.

- Third-party inspection is conducted with the purpose of certifying the compliance of a purchased product or service to international standard codes & customer technical specifications.

- Third-party certification assures that products are safer and more reliable, as they are designed by engineers rather than safety engineers.

- Third-party certification ensures safer and more reliable products design engineers instead of safety engineers to design the product.

Charter Engineer Certificate

- A charter engineer (CE) certificate is required if you are importing goods and materials from other countries to India. So, this certificate is issued to the importer by DGFT.

Declaration Letter

- In the declaration letter, we provide information about the product that does not violate or use material in the product or send a sample to another country. It has no commercial value.

Shipping Bill

- A shipping Bill is an important document required by customs authorities of clearance of goods.

- The shipping Bill is generated by system in two copies one as custom copy & one as exporter copy.

Bill of Entry

- Bill of entry is a legal document filed by importer or custom clearance agent on before the arrival of imported goods.

- It is presented to the custom department as a part of the custom clearance process. Bill of Entry can be issued for domestic consumption or bond clearance.

VGM Copy

- The purpose of the VGM requirement is to obtain the accurate gross weight of packed containers so that ship and terminal operators can prepare vessel storage space plans before loading cargo on ships. This requirement will protect the people and assets of ship and terminal operators as well as the cargo of shippers.

NOC from the Government

- If any goods are exported or imported which contain hazardous related products, then such import or export is permitted with the NOC (No Objection Certificate) obtained from various offices of the government such as if you want to export or import medical related products, then permission is granted with the NOC (No Objection Certificate) obtained from the Drug Controller Office of the Government.

NOC from Manufacturer

GSP (Generalized System of Preferences).

- The Generalized System of Preferences (GSP) is a US trade program designed to promote economic development in the developing world by providing preferential duty-free entry for up to 4,800 products from 129 designated beneficiary countries and territories. The GSP was established on January 1, 1976, by the Trade Act 1974.

E-BRC Electronic Bank Receipt Certificate

- The Bank Receipt Certificate (BRC) is issued by banks on the basis of receipt of payment against exports by the exporter. Any firm applying for benefits under the foreign trade policy is required to submit a valid BRC as proof of receipt of payment against exports made. The BRC details are entered in the DGFT application.

- Bill of Exchange is a written document which is bind one party to pay a specified amount to the second party on demand or a specified data. It is a similar to promising note.